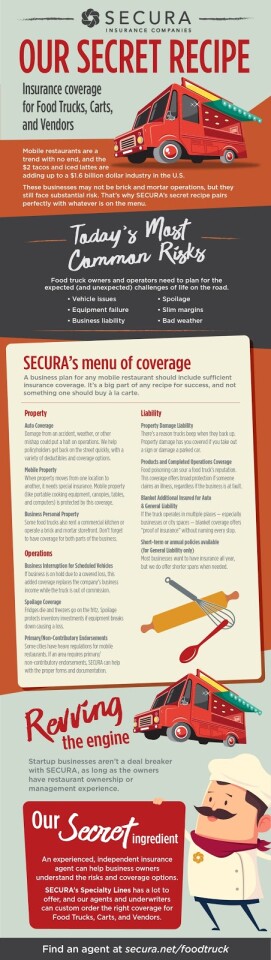

From 2017 to 2022, the food truck industry grew 13.7%, and there are now over 35,000 active food trucks in the U.S. With delicious cuisine, low wait times, and reasonable prices, it’s no wonder business is booming. But, like any business, food trucks are susceptible to risk. We share some common risks for food trucks along with insurance coverages that pair well with any mobile menu.

Vehicle issues

It’s important to properly maintain your food truck, but it’s not always possible to prevent damage or malfunction.

Food spoilage

Mobile restaurants don’t have the luxury of spacious food storage. Just one handling mistake can lead to food spoilage. Constant jostling and shifting from travel can put extra wear-and-tear on equipment, like refrigerators, which can lead to issues or even failure.

Work-related injuries

Though a food truck kitchen is much smaller than a typical restaurant, slips and falls, burns, heat stroke and other work-related injuries can still occur.

Insurance for food trucks

Combat common risks with the proper insurance coverage to help minimize unplanned costs. SECURA Specialty Lines coverage pairs perfectly with whatever you have on the menu. A business plan for any mobile restaurant should include sufficient insurance coverage. Here are some coverages we offer.

Property Insurance

Most businesses want to have insurance all year, but we do offer short-term policies when needed.

Auto Coverage

Damage from an accident, weather, or other mishap could put a halt on operations. We help policyholders get back on the street quickly with a variety of deductibles and coverage options.

Mobile Property

When property moves from one location to another, it needs special insurance. Mobile property (like portable cooking equipment, canopies, tables, and computers) is protected by the coverage.

Business Personal Property

Some food trucks also rent a commercial kitchen or operate a brick and mortar store front. Don’t forget coverage for both parts of the business.

Liability Insurance

Property Damage Liability

There’s a reason trucks beep when they back up. Property damage has you covered if you take out a sign or damage a parked car.

Products and Completed Operations Coverage

Food poisoning can sour a food truck’s reputation. This coverage offers broad protection if someone claims an illness, regardless if the business is at fault.

Operational Insurance

Business Interruption for Scheduled Vehicles

If business is on hold due to a covered loss, this added coverage replaces the company’s business income while the truck is out of commission.

Spoilage Coverage

Fridges die and freezers go on the fritz. Spoilage protects inventory investments if equipment breaks down causing a loss.

Primary/Non-Contributory Endorsements

Some cities have heavy regulations for mobile restaurants. If an area requires primary/non-contributory endorsements, SECURA can help with the proper forms and documentation.

Find a SECURA agent to learn more about these risks and insurance coverage options.