Campgrounds and RV parks insurance

From camping to glamping, we have your business insurance needs covered.

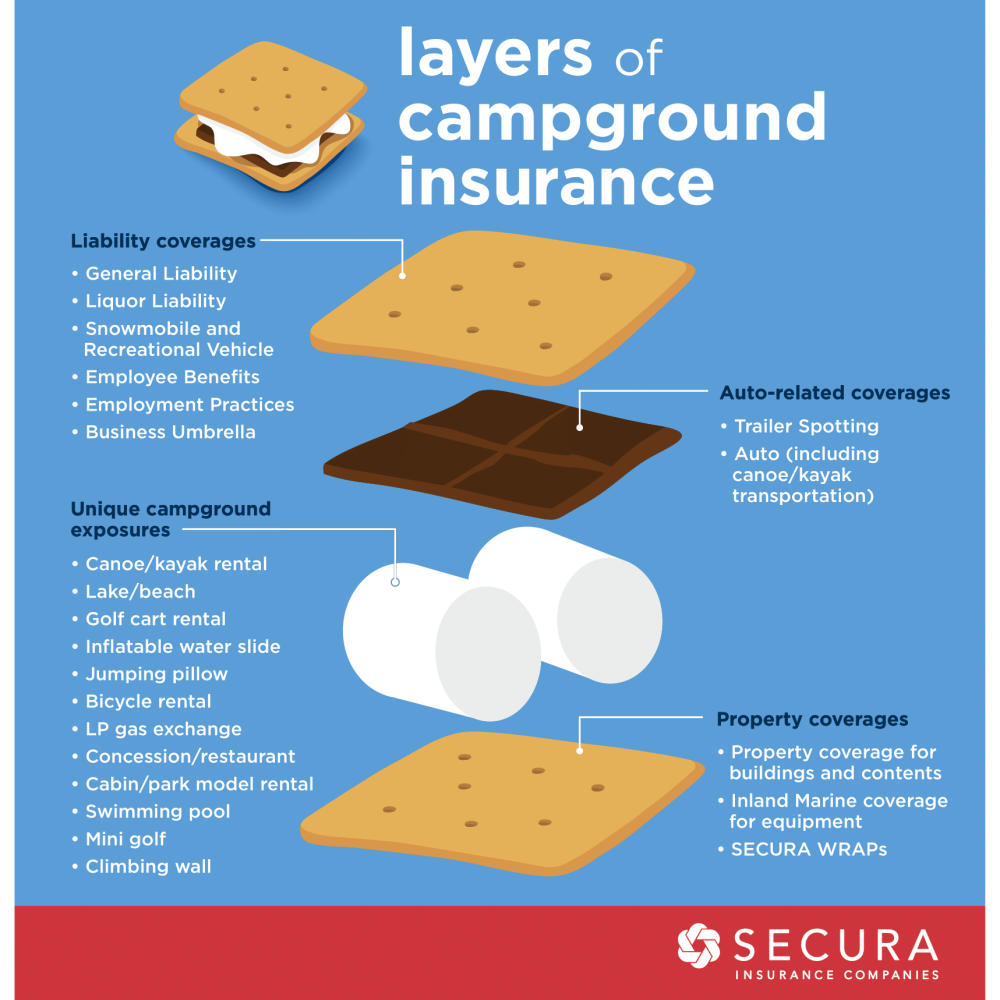

Insurance for campground activities and services.

SECURA covers a wide range of recreational activities and services.

The recreational activities and services you provide your guests are the reasons why many insurance carriers shy away from covering campgrounds — but not SECURA! Recreational activities we help cover through our insurance for campgrounds include these below. If your business offers activities not listed below, talk to your independent agent to see what insurance options are available.

General Liability

As a visiting family sets up their tent, a child trips and falls on an exposed tree root at their campsite. The child’s arm is injured due to the fall and requires medical attention.

General Liability insurance can help cover costs associated with injury, legal fees, and medical expenses related to incidents at your campground.

Commercial Auto

A campground maintenance worker is driving the company pick-up truck and collides with another vehicle on the road. The campground worker injures their knee, and both vehicles sustain significant damage.

Commercial Auto insurance can help cover costs associated with repairs or replacement of the vehicles, as well as related medical expenses.

Inland Marine

An RV park along a lake offers canoe and kayak rentals to guests. When opening the rental stand for the day, a staff member notices two kayaks are missing. Upon investigation, they are found to be stolen by park guests who checked out the day before.

Inland Marine insurance can help cover costs to replace the stolen kayaks, preventing the RV park from paying out-of-pocket.

Benefits that work

Risk management services

Exceptional claims experience

Independent local agents

Why SECURA?

SECURA operates in 13 states with a variety of business insurance solutions, and we are proud to support the communities that have welcomed us for more than a century.