Small business insurance

You have spent a lot of time building your small business. Make sure it’s protected with the right insurance coverages from SECURA.

Your small business is a big deal.

We offer unique coverages to help safeguard your operations, employees, and properties, no matter your industry.

Having the right small business insurance can help cover costs related to property damage, injuries, employee mistakes, and even cyberattacks.

Having the right small business insurance can help cover costs related to property damage, injuries, employee mistakes, and even cyberattacks.

Think SECURA for small business

Why SECURA: Small business insurance — Paroubek Insurance

Why SECURA: Small business insurance — Noah Insurance Agency

Think SECURA for small business

What insurance coverages do small businesses need?

Below are some coverage types we offer, but we encourage you to talk with your independent agent to learn which coverages are right for your small business insurance needs.

Commercial Auto

If your business owns or uses vehicles, you will need Commercial Auto insurance. This coverage protects your business against liability for damages caused by accidents involving your business vehicles. It can also provide coverage to repair your business vehicle if it is damaged in an accident, by an animal, or by a weather event.

Cyber Security

Cyber Security insurance covers expenses related to lost or compromised data, payment fraud, extortion, data restoration expenses, and more.

Employment Practices Liability Insurance (EPLI)

Protect your business from claims made against your company for wrongful termination or discipline, failure to promote, harassment, or defamation of character.

Errors and Omissions

E&O provides coverage for your products and your work if it is damaged due to poor workmanship or defective materials.

General Liability

General Liability insurance helps protect businesses from claims caused by bodily injury, property damage, or personal and advertising injury. These risks can happen to any business, small or large.

Inland Marine

This coverage helps protect your transportable assets. Inland Marine insurance can cover a wide range of specialized property that is movable or could be in transit over land. For contractors, this covers items like employee tools and equipment leased or rented from or to others. Other equipment coverages are also available upon request.

Workers’ Compensation

With SECURA’s Workers’ Compensation insurance, employees receive the proper care, and you experience a safer working environment. This coverage can help reduce injury frequency and severity, saving time and expense.

Commercial Umbrella

Commercial Umbrella insurance for small businesses provides additional liability coverage beyond the limits of their primary insurance policies, offering protection against catastrophic events and costly lawsuits.

Professional Liability

Professional Liability covers judgments or settlements you must pay in the event that you made an error in providing professional services, such as consulting, counseling, or training.

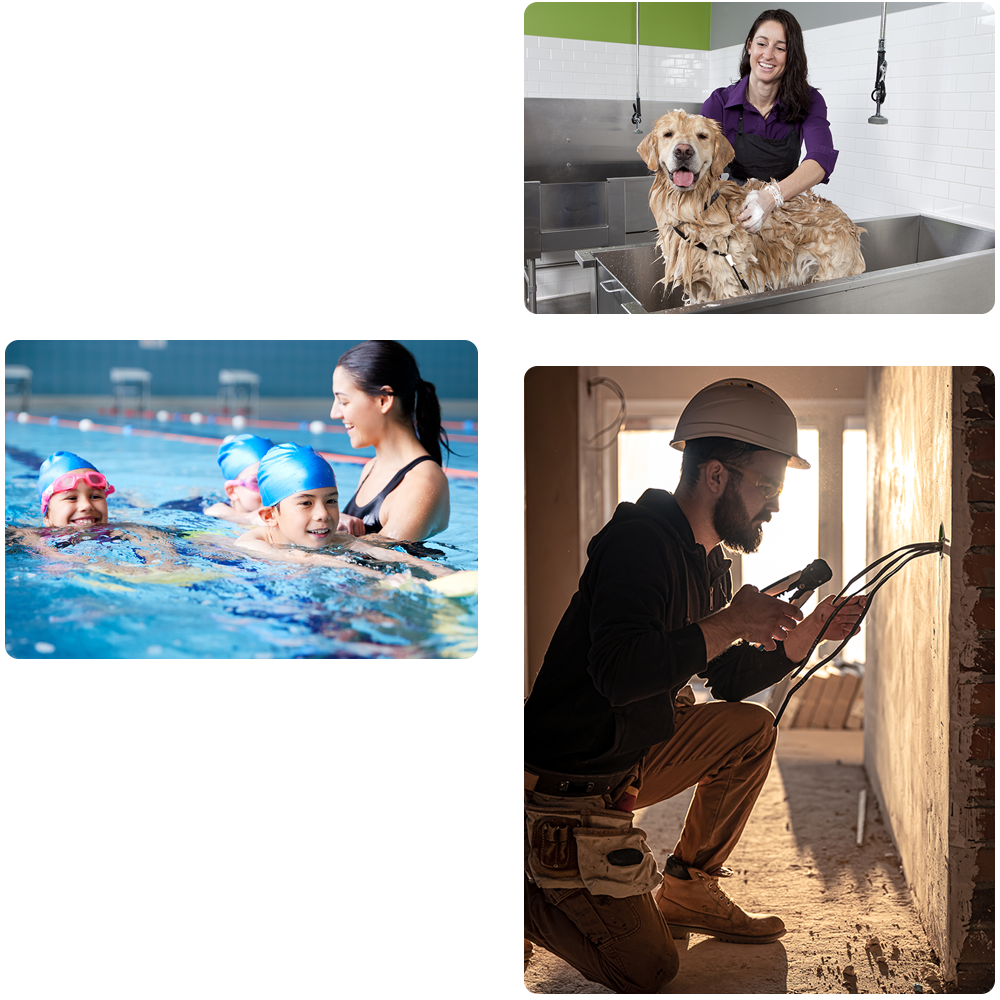

SECURA provides insurance for small business owners within many types of industries

Don’t see your industry listed? Have a conversation with your local agent to learn more about how SECURA Insurance is right for your business.

- Accounting, auditing, and bookkeeping services

- Beauty businesses

- Events

- Health and fitness clubs

- Hunting and fishing guides

- Insurance agents and brokers

- Legal services

- Management consulting services

- Medical offices

- Pet groomers, sitters, walkers, and trainers

- Retail

- Swimming schools, clubs, and leagues

- Trade contractors

- Sports and recreation clubs

Policyholder benefits that work

Risk management

Our policyholders have unlimited access to a wealth of free resources, such as safety talks, safety programs, on-demand videos, and other loss prevention tools.

Exceptional claims service

Our dedicated claims team is empathetic and strives to listen and answer any questions to ensure a full understanding of our process. When you notify us of a loss, we’ll call you within 24 hours, follow up regularly, and work with you until your claim is resolved.

Independent local agents

SECURA works with licensed independent agents in your community who help you find the right insurance solutions for your company. As your company grows, our independent agent partners can help you understand how your company’s insurance needs may change.

Helpful articles

The first step to effectively choosing what coverages you may need is understanding what small business insurance is.

Employers should use every safeguard and precaution available to protect employees from on-the-job injuries.

Cyberattacks can be devastating for a small business owner. It’s important to create a Cyber Incident Response Plan ready in case your business should fall victim to a data breach.

Why SECURA?

Since 1900, we’ve been known for our genuine people and exceptional service. By working with an experienced insurance provider who understands the risks and needs of your businesses, you can ensure you have the right coverage to protect your investment and keep your business running smoothly. In partnership with our independent agents, we can provide a custom insurance policy perfect for your unique needs.

SECURA operates in 13 states with a variety of business insurance solutions, and we are proud to support the communities that have welcomed us for more than a century.

SECURA operates in 13 states with a variety of business insurance solutions, and we are proud to support the communities that have welcomed us for more than a century.