2025 Annual Report

to explore the interactive web page

Financial results

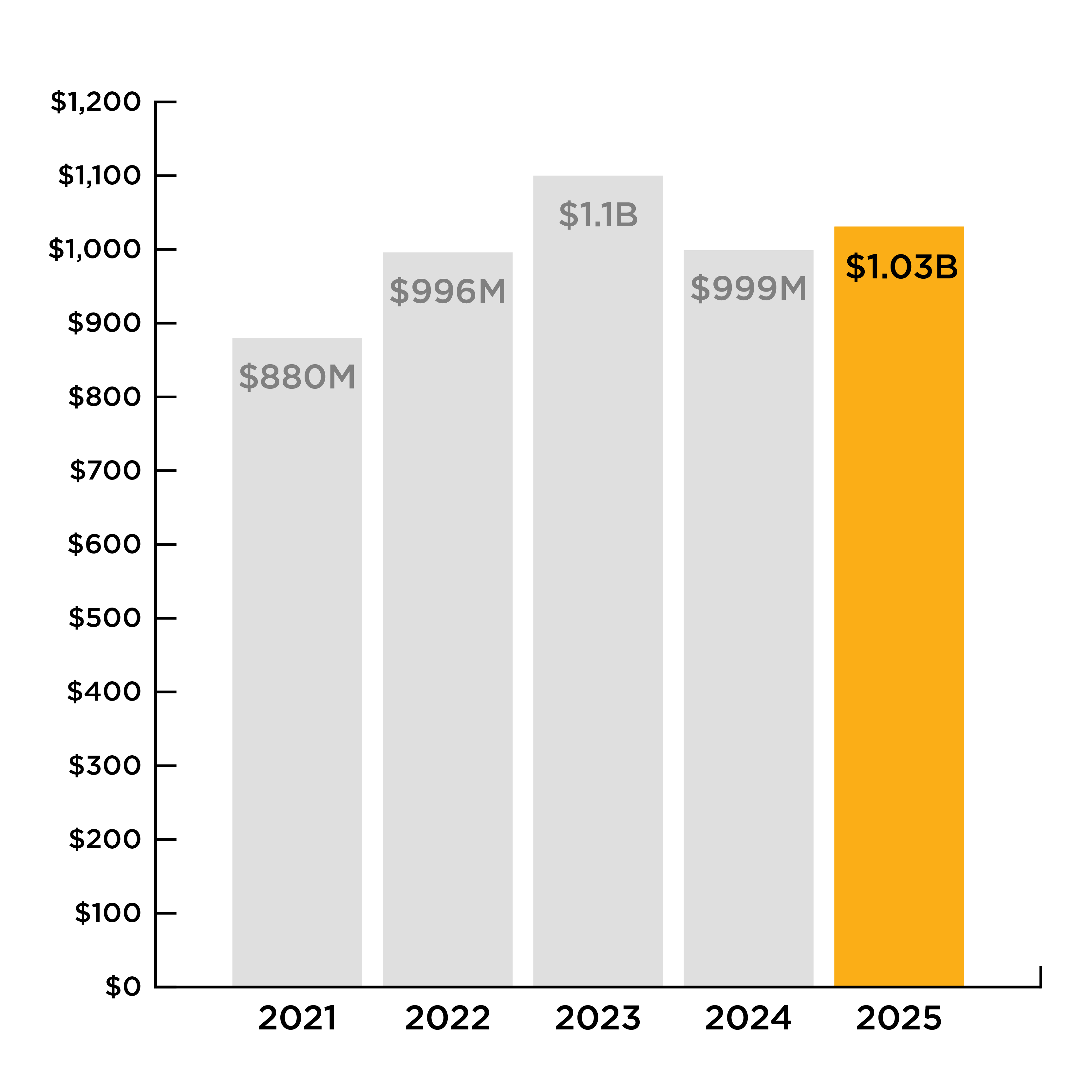

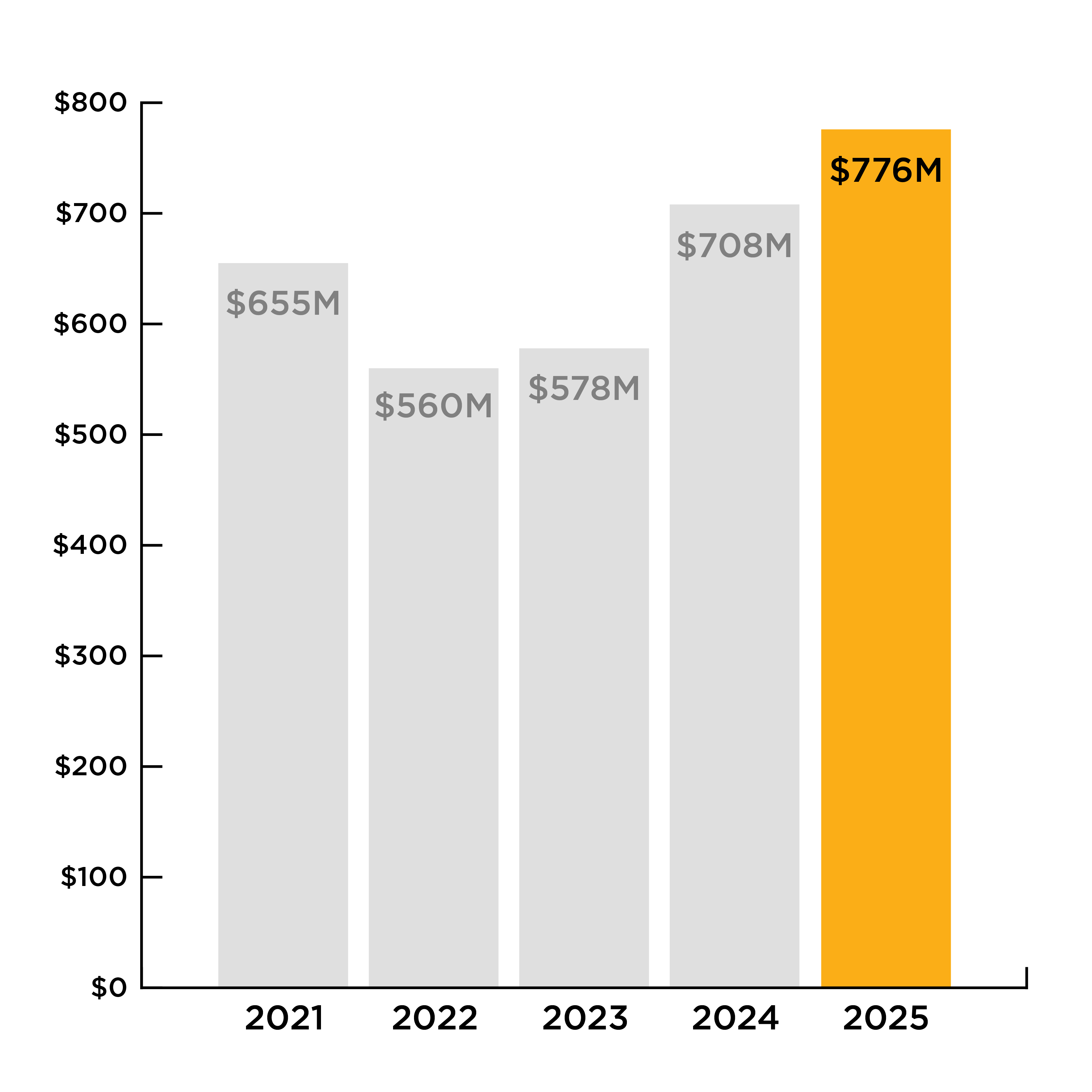

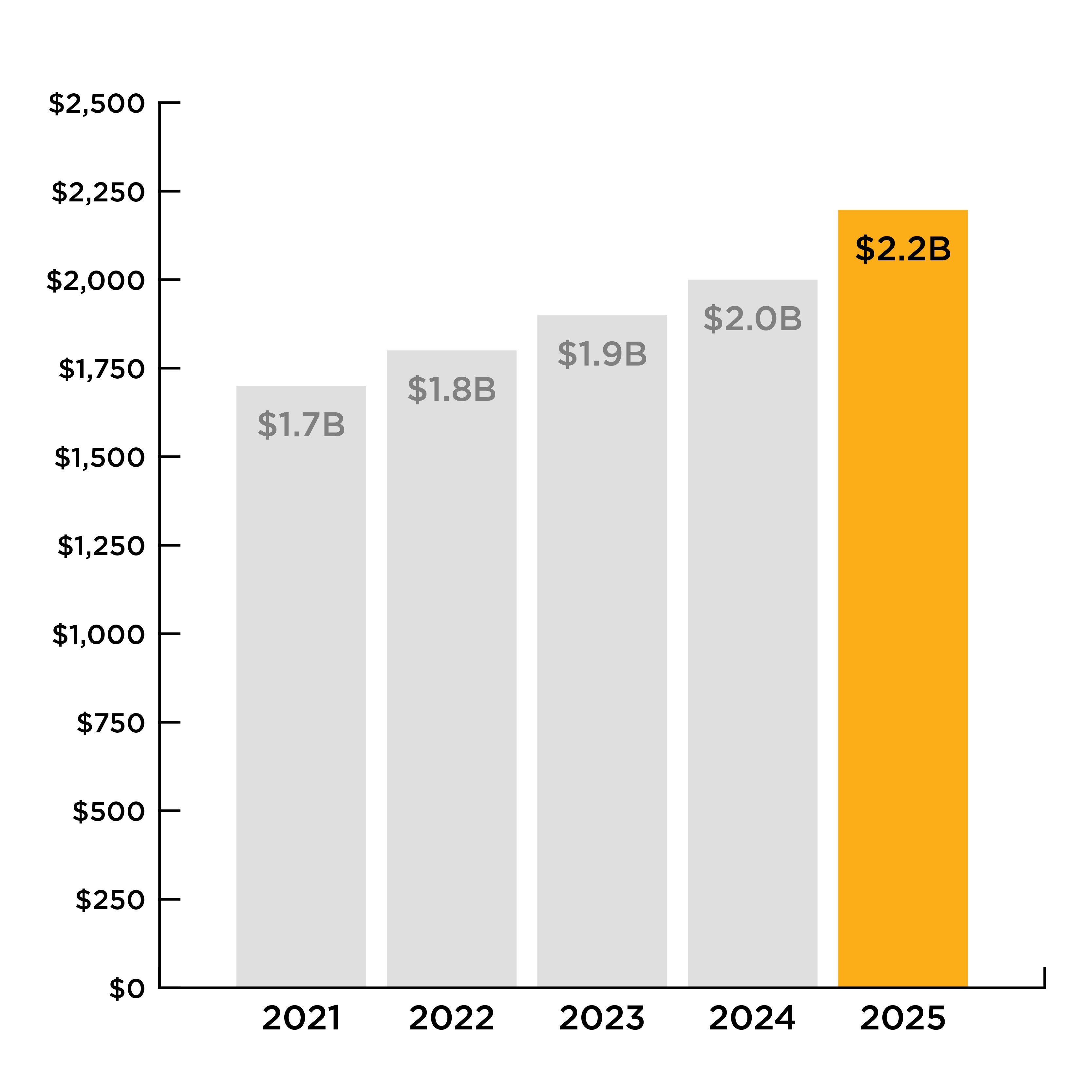

Combined ratio = 97.7%

Loss Ratio

Underwriting Expense Ratio

Loss Adjustment Expense Ratio

Dividend Ratio

5-year combined ratio

125 years of making insurance genuine.

In 2025, we celebrated 125 years of business. This anniversary was more than a celebration of longevity; it was a tribute to the values that have guided us for more than a century: integrity, innovation, and care for our communities.

From the beginning, our company leaders have valued relationships. Those same genuine relationships that founded this company have carried us all the way to our 125th anniversary. To recognize this milestone, we honored our history with special initiatives throughout the year, including:

- Community giving: Expanded charitable contributions and volunteer programs to strengthen the neighborhoods we serve.

- Innovation for the future: Continued investment in digital tools and customer experience enhancements to meet evolving needs.

- Employee engagement: Celebrated our teams with events and recognition programs that reflect our culture of connection.

Journey through time

Scroll through the timeline to view historical photos and fun facts about SECURA throughout the years.

-

1900

Farmers Home Mutual Hail, Tornado, and Cyclone Insurance Company of Seymour, Wisconsin was founded by Julius Bubolz.

-

1926

The company name is changed to Home Mutual Hail-Tornado Insurance Company.

-

1932

The company name changed to Home Mutual Insurance Company.

-

1936

Gordon Bubolz, son of founder, became president and general manager of Home Mutuals (Home Mutual Insurance Company and Home Mutual Casualty Insurance Company).

-

1950

Homestead Mutual was formed to serve more commercialized farms.

-

1981

Home Mutual changed leadership from Gordon Bubolz to his son, John Bubolz.

-

1986

Home Mutual changed its name and updated branding to SECURA Insurance, a mutual company.

-

1997

Leadership changed from John Bubolz to John Bykowski.

-

2010

SECURA Insurance introduced Specialty and Agribusiness Lines.

-

2014

Leadership changed from John Bykowski to David Gross.

-

2019

Associates moved into the new SECURA home office at 1500 Mutual Way in the Village of Fox Crossing.

-

2021

SECURA restructured into a mutual holding company structure.

-

2022

Leadership changed from Dave Gross to Garth Wicinsky.

-

2025

SECURA celebrates 125 years of making insurance genuine; operating in 13 states, providing coverages for a range of businesses, farms, nonprofits, and events.

Giving back

Giving back to the communities where our associates, agents, and policyholders live and work has always been central to who we are. This year, we continued to strengthen that commitment through initiatives that encouraged service, generosity, and community impact.

125 Volunteer Challenge

In honor of our 125th anniversary, we hosted a volunteering challenge, encouraging every associate to dedicate at least 125 minutes to volunteering with an organization of their choice. The challenge reflects our belief that giving back helps our culture thrive and strengthens the communities we serve. Together, our associates contributed an impressive volunteer minutes.

SECURA Gives Back contest

Our annual SECURA Gives Back contest invites agents to nominate nonprofits in their communities for a monetary donation. This year, 13 nonprofits each received a $3,000 donation to support their missions and the important work they do. Since 2017, the SECURA Gives Back campaign has donated a total of $288,500 to winning nonprofits. Community remains at the heart of what we do, and we look forward to continuing to make a meaningful impact together.

Agency relationships

SECURA partners with independent insurance agents in 13 states to distribute its products.

Arizona, Colorado, Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, North Dakota, Pennsylvania, and Wisconsin

In 2025, SECURA continued to strengthen relationships with independent agency partners to drive meaningful growth. We appointed 63 new contracted agencies and added 94 additional locations that align with our strategic priorities and commitment to long-term success. These partnerships position SECURA for continued success as we look ahead to new opportunities and evolving market needs.

Hands at work — our people and culture

SECURA's workforce is a mix of associates located near the company's home office in Neenah, Wisconsin and throughout the U.S. No matter where they work, our associates share a commitment to open communication and strong relationships with each other, agents, and policyholders.

Associates express their satisfaction through the Workplace Strengths Survey, which reports a 95.3% overall satisfaction rating, and through recognition as a Great Place to Work.

We are proud to be 125 years strong, and that milestone would not be possible without the incredible people who have helped shape SECURA along the way. Our associates are the heart of who we are, and many have spent decades growing their careers here while serving our policyholders and communities with care and integrity.

Some of our longest tenured associates reflect on what their careers at SECURA have meant to them, the relationships they have built, and why they continue to believe in the work we do every day.

Recognition and awards

Recognition by industry groups is just one way we measure success. Here's a look back at the awards and accolades we earned in 2025.

- Rated A (Excellent) by AM Best for the 22nd consecutive year

- WELCOA Well Workplace Award at the Platinum level

- Great Place to Work certified for 10th consecutive year

- Green Masters Program as a Green Professional

- Named on the Rising Insurance Star Executives (RISE) 2025 Elite 50 Internships list

- Fortune Best Workplaces in Financial Services & Insurance

- High ratings on Google reviews

SECURA Officers and Board of Directors

SECURA Officers

* Accurate as of Dec. 31, 2025

- Michael Campbell Vice President–Specialty Lines Underwriting

- Christine Cousineau Senior Vice President, Chief Financial Officer, and Treasurer

- Amy DeHart Senior Vice President and Chief Actuary

- Sarah Endter Vice President–Underwriting Services

- Daniel Ferris Senior Vice President, Chief Legal Officer, and Corporate Secretary

- Kyle Galloway Vice President–Software Engineering

- Mary Gronbach Vice President–Investments

- Kristin Heiges Vice President–Marketing

- Timothy Heyroth Senior Vice President and Chief Sales Officer

- Tripp Humston Regional Vice President–Sales

- Logan Jaklin Vice President–Actuarial Services

- Kevin Klestinski Senior Vice President and Chief Underwriting Officer

- Sarah Krause Vice President–Human Resources

- Brian Lindow Vice President–Information Security

- Steven Miller Vice President–Commercial Lines Underwriting

- Jennifer Nelson Vice President–Property Claims

- John Oehler Vice President–Workers' Compensation

- Shane Roh Regional Vice President–Sales

- Sara Stenz Vice President and Controller

- Jill Uitenbroek Vice President–Internal Audit and Enterprise Risk Management

- Carol Wedig Vice President and Chief Information Officer

- Garth Wicinsky President & CEO

- Larry Wright Senior Vice President and Chief Claims Officer

Board of Directors

- Catherine Tierney SECURA Board Chair President and CEO Community First Credit Union

- Mark Behrens Retired Executive Vice President & CFO Johnson Financial Group

- Tim Bergstrom President and CEO Bergstrom Automotive

- Alice Gannon Retired Senior Vice President and Chief Actuary United Services Automobile Association (USAA)

- David Gross Retired President & CEO SECURA Insurance

- Chris Hess President and CEO Goodwill Industries of North Central Wisconsin

- Daniel Neufelder Retired President Indiana University Health — West Central Region

- Barbara Rau Distinguished Professor of Management and Human Resources University of Wisconsin Oshkosh

- John Robison Chief Investment Officer American Fidelity Assurance Company

- Anne Ross Retired Partner Foley and Lardner LLP

- Suzanne Scanlon-Pope Retired Executive Vice President and Chief Information Officer Reinsurance Group of America, Inc.

- Garth Wicinsky President & CEO SECURA Insurance